Report of the 8th Survey of Listed Companies Regarding Institutional Investors' Stewardship Activities

The Government Pension Investment Fund (GPIF) has conducted surveys targeting listed companies every year in order to evaluate the stewardship activities carried out by GPIF's external asset managers. The survey also seeks to ascertain the actual status of, and changes in "purposeful and constructive dialogue" (engagement) between these companies and asset managers. The results of this year's survey were announced as follows.

- Outline of the Survey

■ Subjects: 2,162 TOPIX component companies (as of December 23, 2022)

■ Number of respondent companies: 735 (709 in the previous survey)

■ Response rate : 34.0% (32.5% in the previous survey)

■ Survey period: From January 24 through March 24, 2023

- Comments from Masataka Miyazono, President of GPIF

This is the eighth annual survey that has been conducted, and we are pleased to announce that we have received the largest number of responses ever. We would like to take this opportunity to appreciate all the companies' cooperation that took the time to participate in this survey and provided us with valuable comments and opinions.

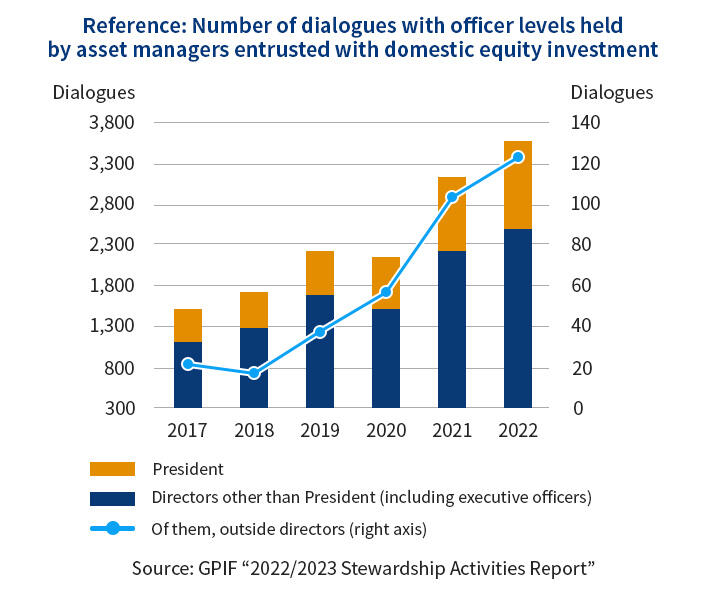

In this survey, we added questions concerning "The status of conducting dialogues between institutional investors and non-executive directors and outside statutory auditors" and "The status of conducting collective engagement," which have been increasingly paid attention over the past several years. Furthermore, we have newly announced the outline of evaluations of engagement by GPIF's asset managers entrusted with domestic equity investment. I am pleased to report that the engagement conducted by GPIF's external asset managers is favorably evaluated by many companies. Going forward, we will continue to encourage asset managers to conduct dialogues from a long-term perspective in order to improve long-term corporate value.

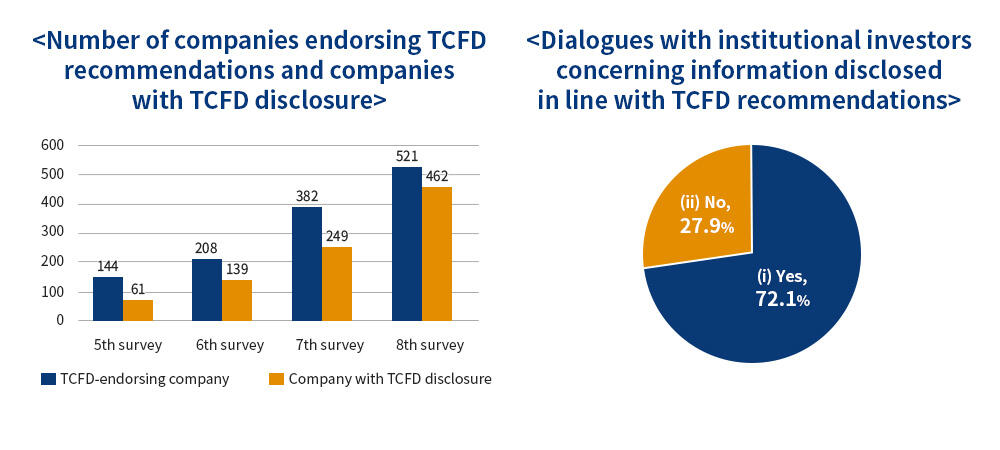

During the past year, we have observed great progress in the number of companies endorsing the TCFD recommendations and the status of their disclosure, and it was also confirmed that dialogues between those companies and institutional investors advanced significantly.

Disclosure and use of information is indispensable for promoting understanding between investors and companies as well as conducting efficient dialogues, which has been making progress. As a result, "engagement" has expanded in a variety of aspects for improving corporate value as the common purpose of companies and investors. This is reassuring and, I would like to express my gratitude to all those people involved in conducting dialogue.

Based on the opinions provided by respondent companies, GPIF will continue to promote initiatives for stewardship activities including engagement with asset managers and ESG initiatives.

- Main Topics of This Survey: Expansion of Engagement

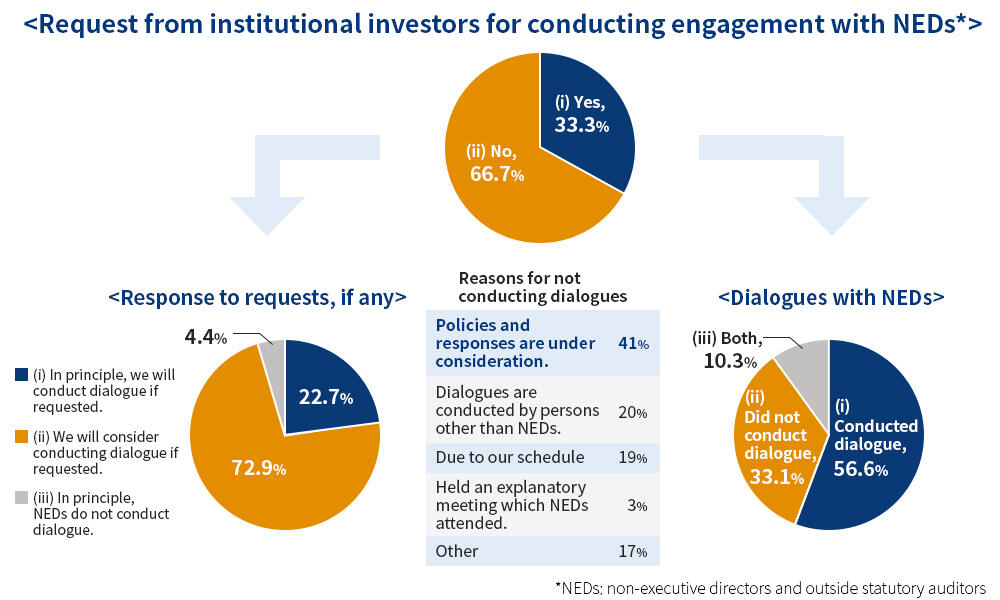

1.Expansion of the scope of persons who handle engagement: Non-executive directors and outside statutory auditors (hereinafter, NEDs)

As our asset managers has increased dialogues with outside directors of their investee companies, the survey results show that many companies that received requests for dialogue with NEDs actually conducted such dialogues. Furthermore, many companies are considering policies and responses for dialogues by their NEDs, and it is likely that dialogues by NEDs will further increase as companies will be more prepared for such dialogues.

<Note>NEDs: Non-executive directors and outside statutory auditors

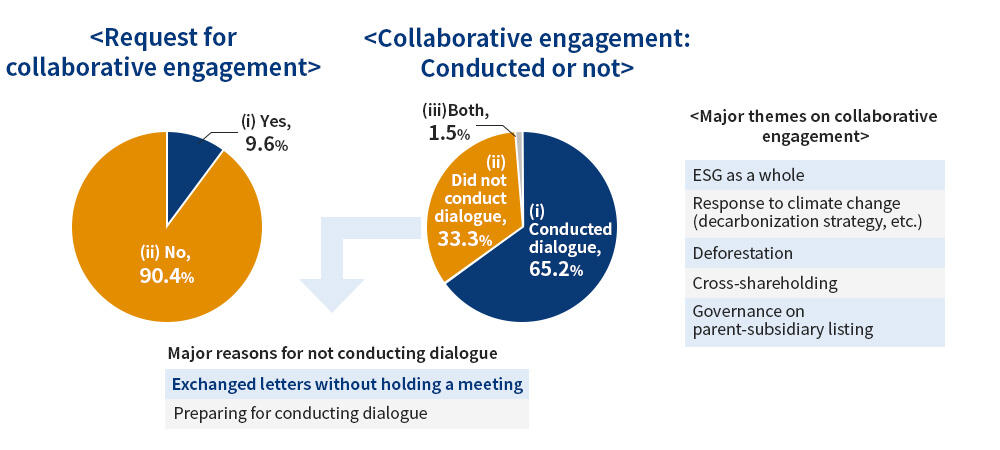

2.Expansion of Engagement Methodology: Collaborative Engagement

There were extremely few companies that declined a request for conducting collaborative engagement. The collaborative engagement framework is expanding to human rights and biodiversity issues. Furthermore, on the back of the increased significance of constructive dialogues between companies and investors, the focus of attention has been on the clarification of the scope of "joint holders," etc. under the large shareholding reporting system.

3.Expansion of Engagement Themes: TCFD Disclosure

As the Corporate Governance Code required companies listed on the Prime Market to disclose information in line with the TCFD recommendations, the number of companies which carry out TCFD disclosure has increased and dialogues with institutional investors concerning what they disclose have made progress. As part of initiatives for promoting constructive dialogues between companies and investors, GPIF publishes "Excellent TCFD Disclosure," in which lists companies were rated as having excellent TCFD disclosure by GPIF's external asset managers entrusted with equity investments.