Report of the 10th Survey of Listed Companies Regarding Institutional Investors' Stewardship Activities

The Government Pension Investment Fund (GPIF) has conducted surveys targeting listed companies every year in order to evaluate the stewardship activities carried out by GPIF's external asset managers. The survey also seeks to ascertain the actual status of, and changes in "purposeful and constructive dialogue" (engagement) between these companies and asset managers. The results of this year's survey were announced as follows.

Status of Response of the Survey

■ Subjects: 1,696 TOPIX component companies (as of January 31, 2025) (2,154 companies in the previous year)

■ Number of respondent companies: 632 (717 in the previous year)

■ Response rate : 37.3% (33.3% in the previous year)

■ Survey period: From January 17 through March 21, 2025

*The number of subject companies decreased significantly as a result of revisions of TOPIX.

Comments from Kazuto Uchida, President of GPIF

We again received responses from a very large number of companies for this tenth survey. We would like to take this opportunity to thank all the companies that took the time out of their busy schedules to participate in this survey and provided us with valuable comments and opinions.

In this survey, we asked additional questions concerning "Current state of IR meetings and other forms of dialogue with institutional investors as a whole" "Changes observed in corporate behavior resulting from dialogue with institutional investors," "Responses to TSE's request regarding Action to Implement Management that is Conscious of Cost of Capital and Stock Price," "Responses to SSBJ's draft of Sustainability Disclosure Standards," and "Sustainability disclosure of the Securities Report."

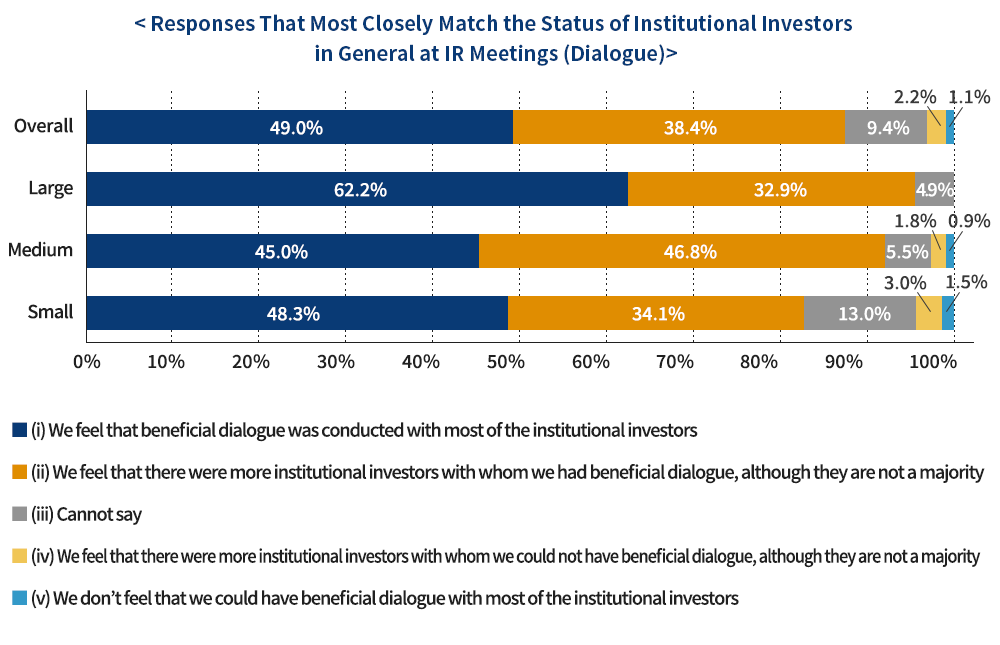

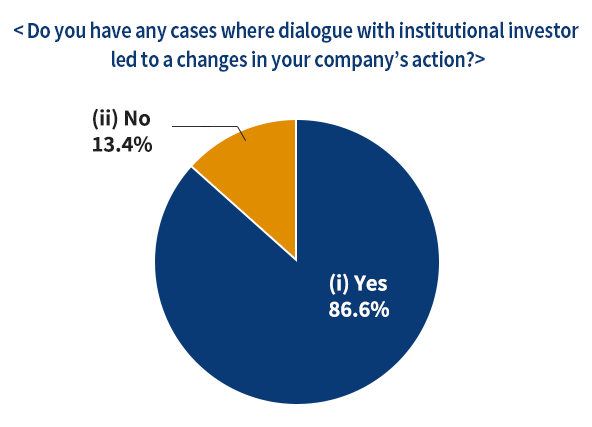

In the past surveys, we sought to ascertain the "changes" of institutional investors' engagement in IR meetings, etc. in general over the past one year. In this 10th survey, we asked for a comprehensive evaluation of the stewardship activities of institutional investors to date. As a result, we found that most of the companies felt that "There were more institutional investors with whom we had beneficial dialogue." Furthermore, the survey suggested that many companies were encouraged by dialogue with institutional investors to change their actions and that their initiatives for the enhancement of corporate value progressed through constructive dialogue between them and institutional investors. Also, in the "Evaluation Project on the Effects of Engagement" published by GPIF in FY 2024, it was indicated that dialogue with external asset managers contributed to changes in corporate behavior and the enhancement of corporate value. This survey provided us with encouraging results that reinforce this indication.

Since we asked many open-ended questions, this placed a considerable burden on companies. We are therefore grateful to have received so many detailed responses, some of which have been included in the published material. These responses contain valuable information, including specific initiatives and concerns of companies, expectations for institutional investors, and good examples of dialogue, which cannot be ascertained from the aggregated figures alone.

We strongly hope that institutional investors will utilize this information for dialogue, and that companies will also refer to it for future initiatives.

Furthermore, in this survey, many companies have responded that they would be willing to cooperate with our interviews and other activities aimed at understanding the actual state of dialogue conducted by our external asset managers.

Based on the responses to this survey as well as the results of interviews, GPIF will continue to further promote stewardship activities and sustainability initiatives.

Main Topics of This Survey

1.Current state of IR meetings and other forms of dialogue with institutional investors as a whole etc.

In this survey, new questions were added in order to properly ascertain the ratings by companies regarding the current status of dialogue with institutional investors in general. As a result, approximately 90% of all respondent companies feel "There were more institutional investors with whom we had beneficial dialogue (sum of responses (i) and (ii))." There were many responses, indicating that companies had beneficial dialogue when they became aware of the investors' point of view (regarding the market environment, the trends of other companies in Japan and abroad) and when they asked questions concerning medium- to long-term management strategies, etc.

Furthermore, we asked new questions on whether dialogue with institutional investors led to changes in the company's actions, in addition to questions on whether dialogue with institutional investors was beneficial. The companies that responded "(i) Yes" accounted for approximately 90%, which indicates that many companies utilize the content of dialogue with institutional investors for their actual initiatives.

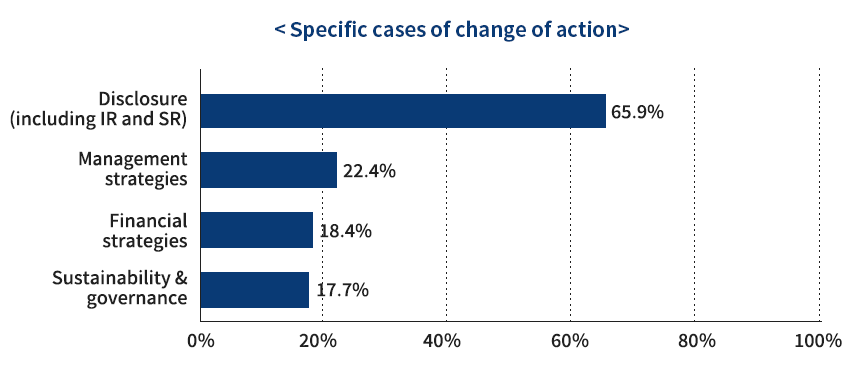

At the same time, the cases in which dialogue led to changes in actions were broadly classified into "Disclosure (including IR and SR)," "Management strategies," "Financial strategies," and "Sustainability

and governance." Among these, "Disclosure (including IR and SR)" was the most common. There were a wide range of responses such as the enhancement of disclosure from a broad perspective whether financial or non-financial, and the strengthening of IR and SR activities. There were not only cases in which companies disclosed, upon request from institutional investors, their conventional activities that had been put into practice but also cases in which their way of thinking and initiatives also changed. Regarding "Management strategy," many comments indicated that dialogue was reflected in the formulation of the company's management plans, and also comments concerning "Management that is conscious of cost of capital and stock price."

*Ratio to valid responses (451 companies). GPIF classified them based on the content of the free descriptive answers. Multiple responses were individually counted. Cases in which dialogue could not judge as actually leading to changes of action, such as the case of an internal discussion in response to investors' comments, are excluded from the count.

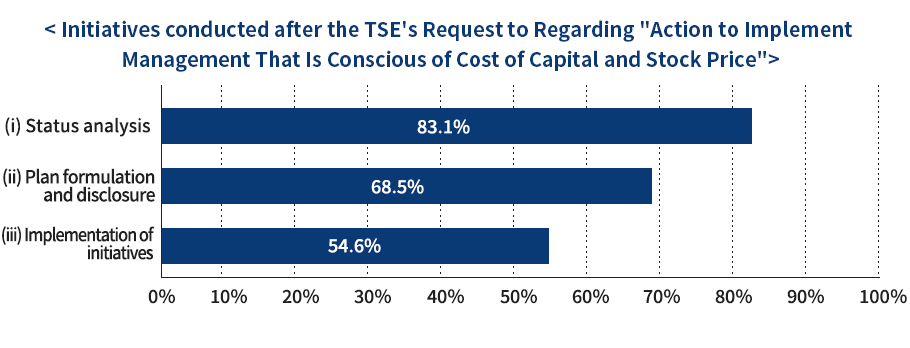

2.Impact of the TSE's Request to Regarding "Action to Implement Management That Is Conscious of Cost of Capital and Stock Price"

In the previous survey, a question regarding the TSE's request to take "Action to Implement Management that is Conscious of Cost of Capital and Stock Price" was added and confirmed the status of internal discussions, etc. In this survey, this question was asked to ascertain the status of companies' responses to TSE's series of requests (the cycle of "Status analysis," "Plan formulation and disclosure," and "Implementation of initiatives"). As a result, more than 80% of companies have implemented "Status analysis", while over 50% have also conducted "Implementation of initiatives."

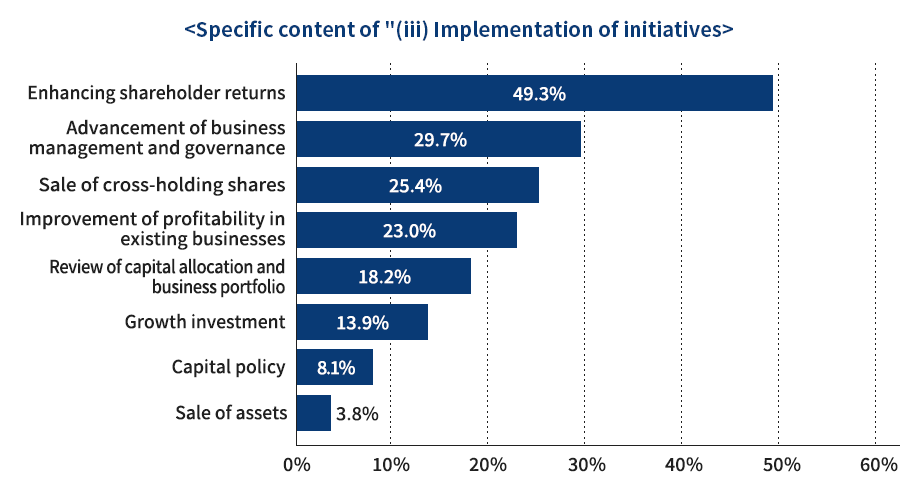

Simultaneously, specific content of "Implementation of initiatives" was also asked, and the answers were roughly classified into "Enhancing shareholder return," "Advancement of business management and governance," "Sale of cross-holding shares," "Improvement of profitability in existing businesses," "Review of capital allocation and business portfolio, "Growth investment," etc. In descending order of the number of responses are "Shareholder return," "Advancement of business management and governance" and "Sale of cross-holding shares." This suggested that priority is given to initiatives with relatively short time spans from decision-making to implementation.

*Ratio to total number of respondents.

*Ratio to valid responses (208 companies). GPIF classified them based on the content of the free descriptive answers. Multiple responses were individually counted. In the case of new investments only, such response is included in "Growth investment" rather than "Review of capital allocation and business portfolio." Content which is interpreted as (i) Status analysis or (ii) Plan formulation and disclosure, and which lacks concreteness, and dialogue with investors were excluded from the count.

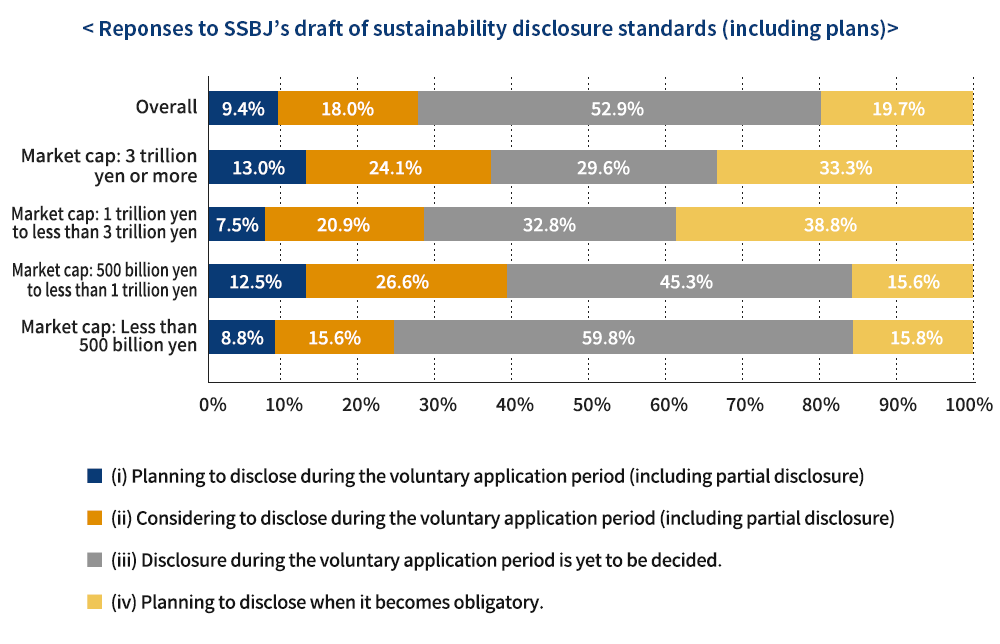

3.Plan for Reponses to SSBJ's Draft of Sustainability Disclosure Standards

In March 2024, the Sustainability Standards Board of Japan (SSBJ) announced the draft of its Sustainability Disclosure Standards. At the time of this survey, discussions on finalization were in progress. Subsequently, three disclosure standards were published in March 2025. Regarding the subject companies and the application period, discussions were still in progress by the Financial System Council of the Financial Services Agency. Therefore, we asked about current plans in this survey. As a result, while the top response was "(iii) Disclosure during the voluntary application period is yet to be decided," other responses "(i) Planning to disclose during the voluntary application period (including partial disclosure)" and "(ii) Considering to disclose during the voluntary application period (including partial disclosure) also accounted for nearly 30%. Furthermore, we observed that the responses varied depending on the market cap of the companies.