Manager Registration System

(Alternative Assets)

GPIF has introduced "Asset Manager Registration System for Alternative Assets" to have more flexibility on Manager Selection.

This system has applied only to discretionary investment management scheme, and doesn't apply to GPIF's direct investment in LPS as a separate investment strategy.

Ⅰ.Asset Class/ Investment style

Fund of Funds products, to be established as Separate Managed Account especially for GPIF, for the following assets.

(1) Fund of Funds product

This product is to invest in the portfolio of alternative investment funds through a separately managed account for GPIF.

① Private Equity

・Global -Diversified

Investment Style: Diversified investments in Private Equity funds with various strategies.

Region: Global

② Infrastructure

・Global

Investment Style: Diversified investments in Infrastructure funds

Region: Global

・Japan Dedicated

Investment Style: Diversified investments in Infrastructure funds

Region: Japan

③ Real Estate

・Global -Core

Investment Style: Diversified investments in mainly Core-type Real Estate funds.

Region: Mainly developed countries (in principle excluding Japan)

・Japan -Core

Investment Style: Diversified investments in mainly Core-type Real Estate funds.

Region: Japan

(2) Single Fund product

This product is to invest in the portfolio of alternative assets through either a separately managed account or a commingled fund.

① Real Estate

・Japan -Core

Investment Style: Core (including Build-to-Core program)

Region: Japan

② Other assets

When new RFP for other alternative assets is called, announcements would be posted on GPIF website and other media.

Ⅱ. Qualification of Asset Managers for Application

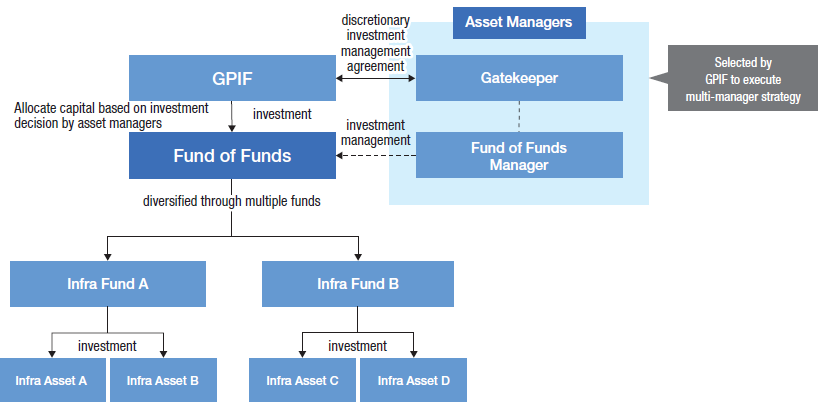

(1) Asset Managers which have registration of Investment Management Business under "Financial Instrument and Exchange Act (Act No. 25 of 1948)" and which could conduct Investment Management Business in Japan based on the registration. An Asset Manager without such registration should apply jointly with a Gatekeeper that is a third party Asset Manager with such registration to qualify as a counterpart to a discretionary investment management agreement/contract with GPIF. (Please see the below chart to confirm the role of "Gatekeeper" and "Fund of Funds Manager".)

If investment decision is effectively made by a Fund of Funds Manager (or a Fund Manager in Single Fund product, collectively a "Manager" hereafter.), the Manager should obtain permission from supervisory authority of the country where their investment teams are located, or the Manager should do registration/ notification based on the laws and regulations of the country.

(2) The company group (*1) that an Asset Manager belongs to must have sufficient experiences in managing clients' assets. The company group (*2) of a Manager to which investment decision is outsourced by a Gatekeeper needs to meet the same qualification.

(*1) A company group includes an applying Asset Manager consisting of a parent company that submits consolidated balance sheets based on the Principle of Consolidated Balance Sheet, subsidiaries, and group companies.

(*2) A company group includes an applying Asset Manager consisting of companies, subsidiaries, and affiliated companies that are subject to consolidated financial statements based on the accounting standards of the countries where their operational bases are located.

(3) If investment decision is effectively made by a Manager, the investment decision should be made by the Manager, which means re-outsourcing is prohibited.

(4) None of companies in a company group is involved in significantly inappropriate behavior regarding investment management business in the past 3 years. If investment decision is made by a Manager instead of a Gatekeeper, the same rule is applied to the company group of the Manager as well.

Example of investment scheme (Infrastructure Fund of Funds)

※ Private Equity and Real Estate investment of Fund of Funds are or will be executed based on the same investment scheme.

※ A Gatekeeper can serve as Fund of Funds Manager concurrently.

Ⅲ. Evaluation Standard for selection

Information regarding Evaluation Standard, please refer to GPIF's Operation Policy. (under preparation)

Ⅳ. The Application Method (Entry)

The application process has been changed since 13th November 2023.

Application (Entry) is available at any time.

(1) Application for Entry (Asset Managers Meeting GPIF's Qualifications)

To apply for entry, please download the "Manager Entry Application Form (Meeting Qualifications)", fill in the required information, and send it to us with the subject "Application_[company name]".

The application process will be completed when GPIF sends a registration completed notification to the asset manager's contact e-mail address.

|

Private Equity |

|

|---|

(2) Product information (Asset Managers Not Meeting GPIF's Qualifications)

To register your product information, please download the "Product information form (Not Meeting Qualifications) ", fill in the required information, and send it to us with the subject "[Company name]". The asset manager can apply for Entry upon meeting GPIF's qualifications.

|

Private Equity |

|

|---|

※Disclosure policy of registered information

Please note that the registered information can be provided to GPIF's consultants, for Asset Manager selection purpose, if necessary. These consultants have a confidential agreement with GPIF, and the registered information is treated as confidential.

Ⅴ. After entry

GPIF may ask registered asset managers to provide additional information and meeting opportunities. However, the starting time of manager selection process is not determined at the moment and wouldn't be publicly announced.