GPIF and IDB launch initiative to promote Social Bonds

January, 16, 2020

Government Pension Investment Fund (GPIF) and Inter-American Development Bank (IDB) have recently formed a partnership to promote and develop sustainable capital markets through a focus on Social Bonds, as well as the incorporation of ESG assessments in fixed income investments.

IDB's Social Bonds are issued in alignment with the Social Bond Principles, which are administered by the International Capital Market Association (ICMA). These bonds provide investment opportunities for GPIF asset managers to contribute to make a sustainable society.

<Comment by Hiro Mizuno, Executive MD and CIO of GPIF>

We are honored to take part in IDB's 'life cycle' approach solving challenges of poverty and inequality in Latin America and the Caribbean through commitments in improving the quality of children's education and providing greater employment opportunities. GPIF requires our asset managers to integrate ESG into their investment analysis and decision-making. We regard the purchase of Green, Social and Sustainability Bonds as one of the direct methods of ESG integration in the fixed income investment. GPIF looks forward to working together on this initiative.

<Comment by Claudia Bock-Valotta, Vice President for Finance and Administration>

We are honored to partner with GPIF to further the development of socially responsible investments. The collaboration between GPIF and IDB integrates social aspects into fixed income investments to support IDB in improving lives in Latin America and the Caribbean.

<Link to the Principles and Guidelines for Green, Social and Sustainability Bonds>

https://www.icmagroup.org/green-social-and-sustainability-bonds/

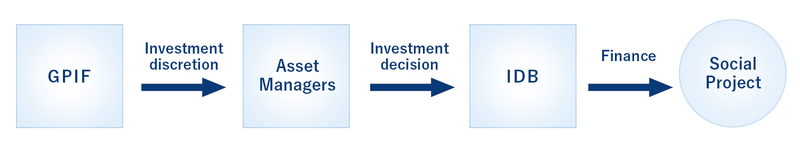

<Investment Scheme>