GPIF and World Bank Group launch new initiative to promote Green, Social and Sustainability Bonds

April, 9, 2019

Government Pension Investment Fund (GPIF) and the World Bank Group have taken further steps to promote ESG integration into fixed income investment as a follow-on initiative to the joint research "Incorporating Environment, Social and Governance (ESG) Factors into Fixed Income Investment" published at the 2018 World Bank Spring Meeting.

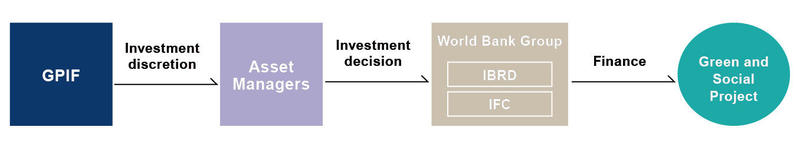

The International Bank for Reconstruction and Development (IBRD) and the International Finance Corporation (IFC)--both members of the World Bank Group--issue Green, Social and Sustainability Bonds that contribute to make a sustainable society, and provides investment opportunities for GPIF's asset managers.

<Comment by Hiro Mizuno, Executive MD and CIO of GPIF>

GPIF requires all asset managers to integrate ESG into their investment analysis and decision-making. We regard purchase of Green, Social and Sustainability Bonds as direct methods of ESG integration. GPIF is committed to promote ESG integration through our investment chain in order to ensure the sustainable performance of the pension reserve fund for all the generations.

<Comment by Kristalina Georgieva, World Bank Chief Executive Officer>

Bond investors can be a key force in moving capital markets towards sustainability when they focus on transparency, purpose and impact. Through our deepening partnership, GPIF is leading by example and demonstrating that ESG considerations go hand-in-hand with long-term financial and social returns.

<Link to ICMA's Principles and Guidelines for Green, Social and Sustainability Bonds>

https://www.icmagroup.org/green-social-and-sustainability-bonds/

<Investment Scheme>

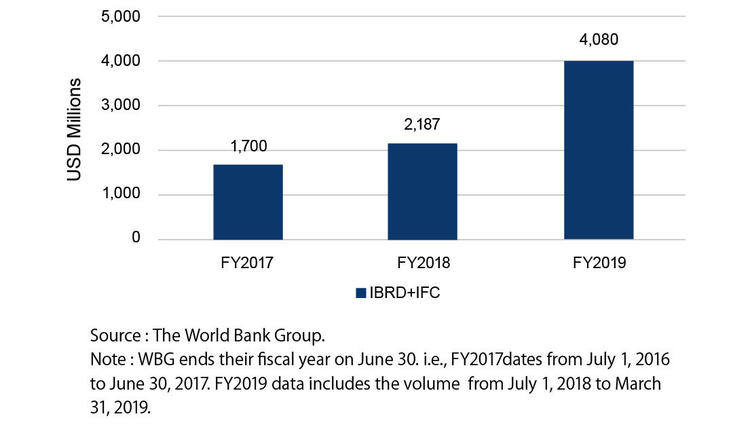

<Green Bonds issued by the World Bank Group>