GPIF and BNG Bank launch initiative to promote Sustainability Bonds

March, 30, 2020

Government Pension Investment Fund (GPIF) and BNG Bank (BNG Bank N.V.) have recently formed a partnership to promote and develop sustainable capital markets through a focus on Sustainability Bonds, as well as the incorporation of ESG assessments in fixed income investments.

BNG Bank is a committed partner for a more sustainable Netherlands. BNG Bank provides financing to the public sector, healthcare institutions and educational institutions at competitive terms and conditions, thereby minimising the costs of social provisions.

BNG Bank's Sustainability Bonds are issued in alignment with the Sustainability Bond Guidelines, which are administered by the International Capital Market Association (ICMA). These bonds provide investment opportunities for GPIF asset managers to contribute to make a sustainable society.

<Comment by Hiro Mizuno, Executive MD and CIO of GPIF>

We would like to leverage the success with multinational development banks in green, social and sustainability bonds partnerships in hopes to expand this to other platforms. GPIF requires all asset managers to integrate ESG into their investment analysis and decision-making. We regard purchase of Green, Social and Sustainability Bonds as one of the direct methods of ESG integration in the fixed income investment. GPIF wish to contribute to make Green, Social and Sustainability bonds mainstream investment products in order to ensure the sustainable performance of the pension reserve fund for all the generations.

<Comment by Olivier Labe, CFO, BNG Bank>

Sustainability is an integral part of BNG Bank's strategy. Our core clients, Dutch municipalities and Housing Associations are fulfilling an important task in the process of energy transition and improving sustainable environment and social conditions. This cooperation with GPIF, the world's largest pension fund, contributes to our mutual mission in helping to build a more sustainable society.

<Link to the Principles and Guidelines for Green, Social and Sustainability Bonds>

https://www.icmagroup.org/green-social-and-sustainability-bonds/

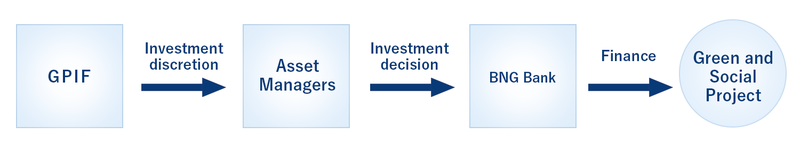

<Investment Scheme>